Buy and Hold in May and Go Away

Shares of semiconductor producers, which I particularly value as the most important part of my investment strategy, have gained a fresh upside momentum and climbed up once again on reports from the SIA (Semiconductor Industry Association) that chip sales exceeded their normal seasonal dynamics in March. Therefore, Broadcom Inc (AVGO) stock price increased by 2.52%, Advanced Micro Devices (AMD) rose by 3.44%, NVidia (NVDA) rose by 3.77% and Micron Technology (MU) added 4.73% to its market price on Monday, May 6.

SIA is a trade association, or to be more precise is a powerful lobbying group and a voice of the American semiconductor industry, yet it used to calculate its sales number carefully. This time it said the amount reached $50.8 billion in the U.S., meaning a solid 16.4% MoM surplus. Preliminary estimates of analysts at a reputable Citigroup, for example, pointed to $50.1 billion keeping its whole year chip sales forecast at 11%, even though its brokerage division represents a rather bullish camp on the issue. In combination with some insights from analog companies this may support a better prospect of planning inventory replenishment in the second half of 2024, Citi supposed in a client's note. Analog and microcontroller units faced a remarkable growth by nearly 50%, which is much higher compared to the average 20%, which would be typical for the very beginning of spring season.

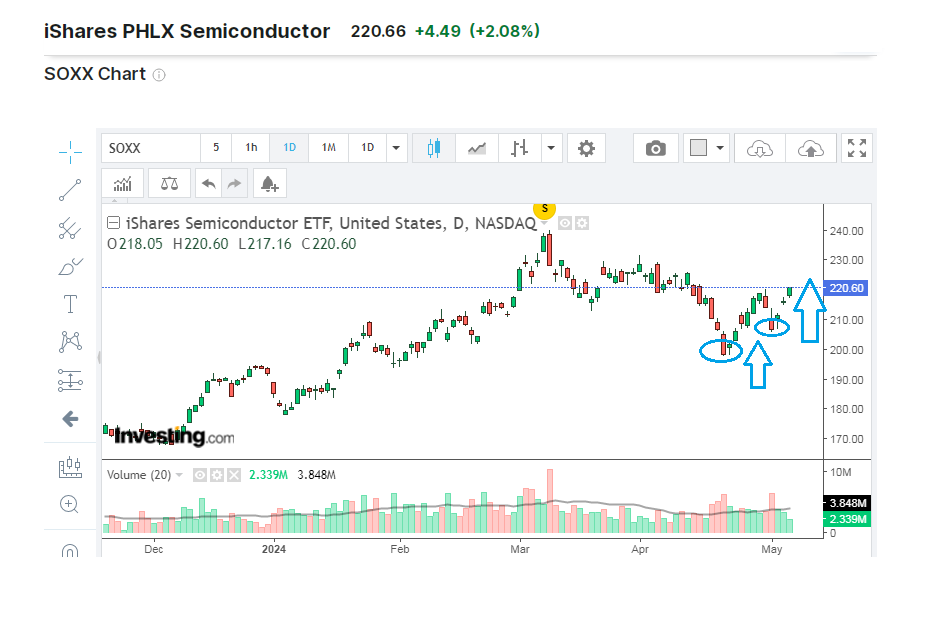

This makes me even more optimistic to not be in a hurry or rush with fixing profit ahead of this new wave of the chip fever before summertime. So, a well-known traders' proverb "Sell in May and go away" could easily be converted into a "Buy and Hold in May and go away" sentence, in my humble opinion, especially as the S&P 500 also continues to recover after its recent price adjustment stage in April. The PHLX Semiconductor Sector's ETF (SOXX) on NASDAQ added 2.08% the same day, bouncing from a dip at 198.4 on April 19 to 220.6 at the moment (11.2% for about a couple of weeks) to reach more than 55% of a return in the recent 12 months. A successful assault on the heights above 240 is on the nearest agenda, with expectations of new record prices for leading chip stocks as the basic scenario.

Disclaimer:

The comments, insights, and reviews posted in this section are solely the opinions and perspectives of authors and do not represent the views or endorsements of RHC Investments or its administrators, except if explicitly indicated. RHC Investments provides a platform for users to share their thoughts on financial market news, investing strategies, and related topics. However, we do not guarantee the accuracy, completeness, or reliability of any user-generated content.

Investment Risks and Advice:

Please be aware that all investment decisions involve risks, and the information shared on metadoro.com should not be considered as financial advice. Always conduct thorough research, seek professional advice, and exercise caution when making investment decisions.

Moderation and Monitoring:

While we strive to maintain a respectful and informative environment, we cannot endorse or verify the accuracy of all user-generated content. We reserve the right to moderate, edit, or remove any comments or posts that violate our community guidelines, infringe on intellectual property rights, or contain harmful content.

Content Ownership:

By submitting content to metadoro.com, users grant RHC Investments a non-exclusive, royalty-free license to use, display, and distribute the content. Users are responsible for ensuring they have the necessary rights to share the content they post.

Community Guidelines:

To maintain a positive and respectful community, users are expected to adhere to the community guidelines of Metadoro. Any content that is misleading, offensive, or violates applicable laws and regulations will be subject to moderation or removal.

Changes to Disclaimer:

We reserve the right to update, modify, or amend this disclaimer at any time. Users are encouraged to review this disclaimer periodically to stay informed about any changes.